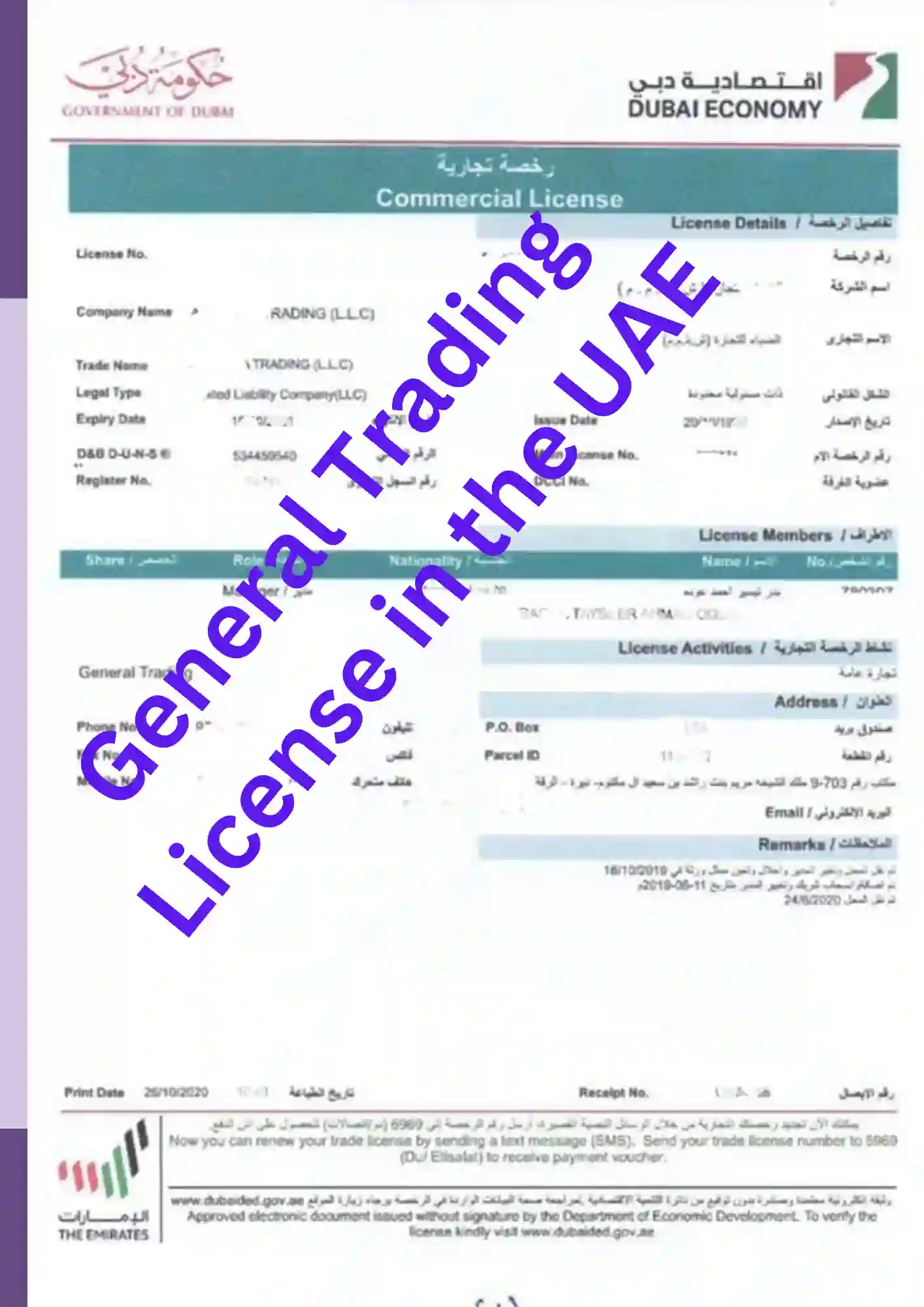

A General Trading License in the UAE provides broad opportunities for entrepreneurs and businesses to engage in various trading activities. This license is ideal for those who wish to trade in multiple sectors without restricting their business activities to a specific category. A general trading license allows the business to import, export, distribute, and sell a wide range of goods and services.

The United Arab Emirates (UAE) is one of the most dynamic and diversified economies in the world, making it an attractive destination for international business and investment. With its strategic location between Europe, Asia, and Africa, the UAE has become a central hub for trade, commerce, and finance. The country’s stable political environment, modern infrastructure, and tax advantages provide a strong foundation for both local and international entrepreneurs.

The UAE is known for its free-market economy, open policies towards foreign investments, and its commitment to economic diversification, particularly in sectors like tourism, real estate, finance, and trade. The government has created a favorable regulatory environment to encourage businesses of all sizes and industries, offering multiple opportunities for investors and entrepreneurs.

A General Trade License is a popular choice among global entrepreneurs. It is a type of commercial license that allows businesses to engage in a wide range of trading activities, including the import, export, and distribution of various goods and products. This license offers flexibility to businesses operating across diverse sectors, such as electronics, textiles, construction materials, and food products. It’s important to understand that a General Trade License is different from a regular trading license. A regular trading license only permits you to trade within a single product category of an industry, while a general trading license allows you to trade in multiple products across various industries

This guide provides a comprehensive overview of starting a general trading company in the UAE, covering various aspects such as licensing, legal structures, and operational requirements.

In the UAE, businesses must obtain a trade license before commencing any commercial activity. There are several types of trade licenses available, each catering to specific business needs. For general trading companies, the most relevant licenses are:

A commercial license offers several advantages for businesses in the UAE:

An industrial license provides specific benefits for manufacturing and production companies in the UAE:

The specific requirements for obtaining a general trading license vary across different emirates in the UAE. Here’s a summary of the key requirements in some of the major emirates:

In addition to the general requirements, certain business activities may require special approvals or permits from relevant authorities in the UAE. These approvals ensure compliance with specific regulations and industry standards. Here are some examples:

The UAE offers numerous free zones, each with its own set of rules, regulations, and benefits. Some of the popular free zones for trading companies include:

Setting up a general trading company in a free zone offers several advantages:

When selecting a free zone for your general trading company, consider the following factors:

| Document | Purpose |

|---|---|

| Passport copies | For identification and verification of shareholders and business owners |

| UAE visa copy or entry stamp | For residency validation (for residents) |

| Proof of residence | To confirm residential address |

| Trade name reservation certificate | To officially register the business name |

| Initial approval certificate | To indicate government approval for the business activity |

| Memorandum of Association (MOA) | To detail shareholder roles and capital distribution (for mainland businesses) |

| Lease agreement or Ejari certificate | To confirm business premises |

| No Objection Certificate (NOC) | Required for individuals already employed in the UAE |

| Feature | Commercial License | Industrial License | Professional License |

|---|---|---|---|

| Purpose | Trading, importing, and exporting goods | Manufacturing, production, and packaging | Providing services based on skills and expertise |

| Activities | Buying and selling goods, import/export, distribution | Manufacturing, processing, assembling | Consultancy, legal services, accounting, IT services |

| Ownership | Mainland: Typically 49% foreign ownership (100% in some sectors) Free Zone: 100% foreign ownership | Mainland: May require local sponsor Free Zone: 100% foreign ownership | Mainland: May require local service agent Free Zone: 100% foreign ownership |

| Liability | Limited liability | Limited liability | Typically unlimited liability (unless registered as LLC) |

| Visa Quota | Allows multiple visas based on business size and office space | Allows visas based on the number of employees and office space | Usually limited to 1-2 visas |

| Office Requirements | Required for mainland companies | Requires physical industrial space or warehouse | May or may not require office space |

| Cost | Varies by emirate and free zone | Varies by emirate and free zone | Varies by emirate and free zone |

| Feature | Mainland License | Free Zone License |

|---|---|---|

| Market Access | Unrestricted trade within the UAE and internationally | Restricted trade within the UAE; requires local distributor |

| Ownership | Typically requires a local sponsor (51% ownership) | 100% foreign ownership allowed |

| Tax Benefits | Subject to corporate tax | 0% corporate tax |

| Customs Duty | 5% customs duty on imports and exports | Often duty-free within the free zone |

| Regulations | Subject to UAE commercial laws | Governed by the specific free zone’s regulations |

The time frame for setting up a general trading company in the UAE can vary depending on the chosen jurisdiction, the complexity of the business activities, and the efficiency of the application process. In general, the process can take anywhere from a few weeks to a couple of months.

The standard processing time for obtaining a General Trading License in Dubai is typically 7 to 14 business days, assuming all requirements are met.

A General Trade License is suitable for businesses involved in the import, export, and trade of a wide range of goods and products. This includes businesses dealing with:

It’s important to note that certain products, such as automobiles, alcoholic beverages, and medical supplies, may have restrictions and require specific licenses for import or export.

Dubai offers two primary jurisdictions for businesses – Mainland and Free Zones. Mainland companies are regulated by the Dubai Department of Economy and Tourism (DET) and may require a local sponsor or partner, depending on the business activity. Free Zones, on the other hand, allow 100% foreign ownership and offer various benefits such as tax exemptions and simplified business regulations. The process of obtaining a General Trade License can be complex, and seeking assistance from business setup consultants may be beneficial. The process generally involves the following steps:

The required documents may vary depending on the business structure, shareholders, jurisdiction, and other factors. Here’s a categorized list of some common documents:

The cost of obtaining a General Trade License in Dubai varies depending on several factors, including the chosen jurisdiction (Mainland or Free Zone), business activities, company structure, visa requirements, and office space. The approximate cost of a General Trading License in Dubai ranges from AED 12,500 to 35,000. The total cost of registering a trade license in Dubai can range from AED 15,000 to AED 50,000.

| Cost Category | Mainland Dubai | Free Zones |

|---|---|---|

| License Fees | AED 12,500 to AED 15,000 | Similar to Mainland, may be lower in some Free Zones |

| Additional Fees | DED Activity fees (AED 15,000), Trade Name Reservation cost (AED 620) | May vary depending on the Free Zone |

| Maintenance Costs | Annual renewal fees, visa renewals, office rent, administrative costs | Annual renewal fees, visa renewals, office rent, administrative costs |

The cost of obtaining a General Trading License in the UAE varies across emirates and free zones. This section provides an overview of costs in Abu Dhabi, Sharjah, Ajman, Ras Al Khaimah, and Umm Al Quwain.

The cost of a commercial license in Abu Dhabi can range from AED 10,000 to AED 70,000. The average cost of a trade license in Abu Dhabi is approximately AED 20,000. Free zone licenses, such as in KIZAD, can start from AED 11,000. Abu Dhabi Department of Economic Development (ADDED) offers different license types including Tajer Abu Dhabi and Instant Trade License.

| License Type | Approximate Cost (AED) | Notes |

|---|---|---|

| General Commercial License (Mainland) | 10,000 – 70,000 | Varies based on business activity, shareholders, and employees. Average around AED 20,000. |

| Free Zone License (KIZAD) | From 11,000 | Starting cost in Khalifa Industrial Zone Abu Dhabi (KIZAD). |

| Tajer Abu Dhabi License | To be confirmed | Specifically for e-commerce businesses, no office space required. |

| Instant Trade License | To be confirmed | Quick setup for sole proprietorships and partnerships, minimal paperwork, online process. |

Note: These costs may vary based on the specific business activities, the company’s legal structure, and office space requirements. It’s essential to confirm the exact cost with the relevant authorities.

| License Type | Approximate Cost (AED) | Notes |

|---|---|---|

| General Trading License | 5,000 – 30,000+ | Cost range depending on the specific license and business activities. |

| Sharjah Airport Int’l Free Zone (SAIF Zone) | 5,000 – 30,000 | Free zone costs within the general Sharjah range. |

| Sharjah Media City Free Zone (SHAMS) | 6,875 | Specific free zone cost for media-related businesses. |

Note: These costs may vary based on the specific business activities, the company’s legal structure, and office space requirements. It’s essential to confirm the exact cost with the relevant authorities.

| License Type | Approximate Cost (AED) | Notes |

|---|---|---|

| General Trading License (LLC) | 14,000 | Cost for Limited Liability Company structure. |

| General Trading License | 35,150 | Cost mentioned as one of the lowest for General Trading Licenses in the UAE. GCC registration is required. |

Note: These costs may vary based on the specific business activities, the company’s legal structure, and office space requirements. It’s essential to confirm the exact cost with the relevant authorities.

| License Type | Approximate Cost (AED) | Notes |

|---|---|---|

| General Trading License | 10,000 – 20,000 | Cost range for General Trading Licenses in Ras Al Khaimah. |

| Ras Al Khaimah Economic Zone (RAKEZ) | 15,000 | Free zone cost within RAKEZ. |

Note: These costs may vary based on the specific business activities, the company’s legal structure, and office space requirements. It’s essential to confirm the exact cost with the relevant authorities.

| License Type | Approximate Cost (AED) | Notes |

|---|---|---|

| Smart Business License (1 visa) | 16,500 | Lower cost option with limited visa quota. |

| Regular Trading/Consultancy License (2 visas) | 20,500 | Standard license with a quota of 2 visas. |

| Premium Consultancy License (3 visas) | 32,500 | Higher cost option with a larger visa quota. |

| General Trading License (3 visas) | 27,500 | Cost for general trading activities with 3 visas included. |

Note: These costs may vary based on the specific business activities, the company’s legal structure, and office space requirements. It’s essential to confirm the exact cost with the relevant authorities.

The UAE offers various legal structures for setting up a trading company, each with its own advantages and considerations:

This structure is suitable for individuals who want complete control over their business. However, it comes with unlimited liability, meaning personal assets are not protected from business debts.

This is the most common company type in the UAE, offering limited liability to shareholders, protecting their personal assets from business debts. LLCs require a minimum of two shareholders.

This structure involves two or more partners who share profits, losses, and liabilities. In a simple limited partnership, UAE nationals must be general partners, while partners of other nationalities must be limited partners.

This structure is for professional businesses like consultancy firms, where the partners are the sole owners. If no UAE or GCC nationals are partners, a local service agent is needed.

This structure allows 100% foreign ownership and offers tax benefits, but may have restrictions on trading directly in the local UAE market.

Suitable for large enterprises, this structure requires a minimum of 10 founders and allows public trading of shares. The chairman and majority of directors must be UAE nationals.

Similar to a PJSC but with shares not offered to the public, this structure requires a minimum of three shareholders.

The UAE has a favorable tax environment for businesses, with the following taxes applicable to trading companies:

Introduced in 2023, the corporate tax rate is 9% for taxable profits exceeding AED 375,000. Companies with taxable profits up to AED 375,000 are not subject to corporate tax. Free zone companies may be exempt from corporate tax if they meet certain conditions.

Implemented in 2018, VAT is levied at a standard rate of 5% on most goods and services. Some goods and services are zero-rated or exempt from VAT. Businesses must register for VAT if their annual taxable supplies exceed AED 375,000.

A 5% customs duty is imposed on the CIF value of most imports. Exemptions and reliefs may be available for certain goods.

Excise tax is levied on specific goods deemed harmful to health or the environment, such as tobacco, energy drinks, and carbonated drinks, at rates ranging from 50% to 100%.

VAT is an indirect tax on the consumption or use of goods and services levied at the point of sale. The standard VAT rate in the UAE is 5%.

Navigating the process of setting up a general trading company in the UAE can be complex and time-consuming. With various legal structures, tax implications, and regulatory requirements to consider, it’s essential to have expert guidance every step of the way. Here’s how we can assist you:

By partnering with us, you can confidently navigate the complexities of setting up a general trading company in the UAE. Our expertise and support ensure a smooth and efficient process, allowing you to focus on building a successful business in this thriving economy.

Embassies Attestation

Al Khazna Tower – Office #1617, 16th Floor, Najda Street, Abu Dhabi, UAE

Copyright 2026© All Rights Reserved. GloboPrime Corporate Services - Specialists in Business Setup UAE & MOFA Attestation Abu Dhabi.