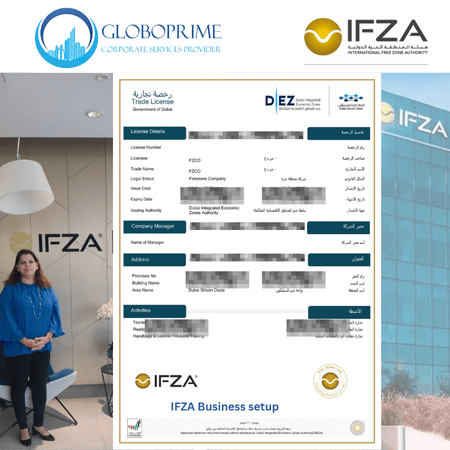

IFZA Business Setup in Dubai – Company Formation, License Cost & Process

Looking to establish your business in Dubai’s leading free zone? The International Free Zone Authority (IFZA) in Dubai offers one of the UAE’s most cost-effective and flexible business setup options. Entrepreneurs benefit from 100% foreign ownership, zero personal income tax, and licenses covering multiple activities. Whether you’re a startup, SME, or global investor, our experts guide you through every step from calculating IFZA license costs and preparing documents to securing visas, multi-year discounts, and a corporate bank account.

IFZA (International Free Zone Authority) Dubai

IFZA, or the International Free Zone Authority, is one of the fastest-growing and most competitive free zones in the United Arab Emirates. Established in 2018 and strategically situated within Dubai’s business-friendly environment, IFZA is regulated by the Dubai Silicon Oasis Authority. It provides a dynamic business ecosystem designed to support SMEs, startups, and large international corporations, contributing significantly to the region’s economic advancement and attracting substantial foreign direct investment.

With its focus on exceptional support, world-class amenities, and highly customized company formation packages, IFZA offers an ideal platform for entrepreneurs to thrive and innovate.

IFZA’s Contribution to the UAE Economy

- SME Empowerment: IFZA lowers entry barriers for small and medium-sized enterprises, promoting greater economic diversity in Dubai and the UAE.

- Employment Generation: The free zone hosts a workforce in the thousands, contributing to Dubai’s employment landscape.

- Foreign Direct Investment (FDI): With its competitive setup costs and 100% foreign ownership model, IFZA helps channel international capital into the UAE.

- Sectoral Growth: Sectors like IT, professional services, and e-commerce have seen a marked 25-30% growth within IFZA in the last few years.

Choosing IFZA for Your Business Setup

Choosing IFZA for your business setup positions your company within a supportive ecosystem that emphasizes efficiency, flexibility, and growth. Here are the core benefits and unique features that make IFZA an ideal choice for your venture in 2025.

Core Benefits of IFZA Company Formation

- 100% Foreign Ownership: Unlike mainland companies, IFZA allows complete foreign ownership, granting you full control over your enterprise without the need for a local Emirati partner.

- Tax Benefits: Enjoy a tax-friendly environment with 0% corporate and personal income tax, 100% exemption from import and export duties within the zone, and full repatriation of profits and capital.

- Cost-Effective Licensing: IFZA is renowned for its competitive licensing packages, with fees starting as low as AED 12,900 for a zero-visa quota license, making it highly attractive for startups and SMEs.

- Strategic Dubai Location: Leverage Dubai’s world-class infrastructure, global connectivity near Dubai International Airport, and access to a consumer market of over 2.5 billion people across the MENA region and beyond.

- Efficient Incorporation Process: The company formation process is straightforward and can be completed within 5-10 business days, minimizing administrative burdens and allowing you to commence operations swiftly.

- Diverse License & Activity Options: IFZA caters to a vast range of business activities, offering Professional, Commercial, Industrial, Service, and Holding licenses, with the flexibility to combine activities under a single license.

- Easy Bank Account Setup: Once your license is issued, most local and international banks in the UAE readily accommodate IFZA-registered companies for corporate bank account opening.

- Visa Eligibility: Secure residence visas for shareholders, employees, and their family members under your IFZA company structure, with visa validity of up to 2 years.

Unique Features That Make IFZA Stand Out

- No Physical Office Requirement: Operate your business using flexible office solutions, including flexi-desks and virtual offices, eliminating the high overhead costs associated with a physical office.

- No Share Capital Requirement: You are not required to show proof of a minimum share capital, lowering the barrier to entry for new businesses.

- No Employee Guarantee Deposit: Unlike some other free zones, IFZA does not require a guarantee deposit for your employees’ visas.

- Remote Setup Possible: The physical presence of shareholders is not required for the incorporation process, allowing for a completely remote setup.

- Minimal Documentation: The setup process requires minimal paperwork, typically only passport copies, application forms, and visa/EID copies for UAE residents.

Types of Business Licenses in IFZA

Setting up a business in the International Free Zone Authority (IFZA), Dubai, begins with choosing the right license. IFZA offers several license types to fit different business activities, from professional services to international trade. Understanding these options is the first step toward a successful launch.

IFZA offers five main types of business licenses: Professional, Commercial, Industrial, General Trading, and Holding. Each license caters to specific business activities, allowing entrepreneurs and companies to operate legally within the free zone.

IFZA License Types Explained

Below is a detailed look at each license, what it covers, and who it’s best for.

1. Professional License

This license is for businesses providing professional services. It’s ideal for consultants and service-based professionals.

Best For: Management Consultants, IT Experts, Marketing Professionals, and Business Consultants.

Activities Covered: A broad range of professional services. IFZA allows for the combination of multiple consulting activities under this single license.

2. Commercial License

Designed for businesses trading in specific goods, the Commercial License covers the import, export, storage, and distribution of products.

Best For: Import/export businesses and trading companies focused on specific industries.

Activities Covered: Trading of a wide variety of pre-approved products. You can combine different trading activities on one license.

3. Industrial License

This license is required for businesses involved in manufacturing, processing, packaging, or assembling goods.

Best For: Manufacturing units, processing plants, and assembly facilities.

Activities Covered: Importing raw materials, followed by the production, processing, and export of finished goods. A physical warehouse or facility is necessary.

4. General Trading License

The General Trading License provides maximum flexibility, allowing a business to trade a wide variety of goods across different sectors.

Best For: Companies with a diverse product portfolio or those wanting to trade multiple products without being restricted to a specific industry.

Activities Covered: Broad trading of most goods, except for a few regulated items (like pharmaceuticals) that need special approvals.

5. Holding Company License

This is a specialized license for a parent company that holds shares in other companies or owns assets like real estate or intellectual property.

Best For: Corporations aiming to manage subsidiary companies or hold and protect assets.

Activities Covered: Holding shares in other legal entities and owning standalone assets.

Which IFZA License Should You Choose? A Quick Comparison

| License Type | Best For | Key Feature |

|---|---|---|

| Professional | Consultants & Service Providers | Allows multiple service activities on one license. |

| Commercial | Trading Specific Goods | Flexible combination of trading activities. |

| Industrial | Manufacturing & Processing | Enables full production cycle from raw material to export. |

| General Trading | Diverse Trading Activities | Trade almost any commodity with few restrictions. |

| Holding Company | Asset & Share Management | Ideal for corporate structuring and asset protection. |

IFZA Business License Cost & Packages

Understanding the complete investment is crucial for budgeting your company setup in IFZA. The costs can be broken down into four main categories: the core license package, mandatory associated fees for visas and immigration, office space options, and annual renewal costs.

(Note: All prices are in AED and are based on the latest available information for 2025. These are subject to change. For up to date information, consult with our expert business setup advisor for a precise, up-to-the-minute quotation and information on current promotions.)

1. IFZA License Packages (1-Year & Multi-Year)

The primary cost is the business license, which is priced based on the number of residence visa quotas your company requires. IFZA offers significant discounts for multi-year packages, making it a cost-effective choice for long-term planning.

Special Promotion: IFZA frequently runs a “1 Residence Visa FREE For Life” offer on all packages with one or more visa allocations. This promotion waives the government visa issuance and renewal charges for one designated individual for the life of the company. However, it does not cover associated costs like the Establishment Card, medical tests, or Emirates ID fees.

Comprehensive IFZA License Cost Table (2025)

| Visa Quota | 1-Year License | 2-Year License (15% Savings) | 3-Year License (20% Savings) | 5-Year License (30% Savings) |

|---|---|---|---|---|

| 0 | 12,900 | 21,900 | 31,000 | 45,200 |

| 1 | 14,900 | 25,300 | 35,800 | 52,200 |

| 2 | 16,900 | 28,700 | 40,600 | 59,200 |

| 3 | 18,900 | 32,100 | 45,400 | 66,200 |

| 4 | 20,900 | 35,500 | 50,200 | 73,200 |

Terms & Conditions

- Price list is applicable to all new IFZA Free Zone licenses and remains fixed for the next three renewals (total of 4 years).

- The “1 Residence Visa FREE for Life” privilege is available with license packages that include at least one visa quota. It covers visa issuance and renewals for a chosen individual, while Establishment Card, medical, and Emirates ID expenses remain chargeable.

- This free visa is assigned to one individual only and cannot be transferred. In case of rejection, substitution is possible with a minimal processing fee.

- All discounts are strictly based on the official price list and cannot be combined with other promotional campaigns.

- General trading and cross-activity charges are waived for new licenses as well as renewals for up to 4 years.

- The lock-in downpayment plan applies to both 1-year and multi-year packages. Please note, this downpayment is non-refundable if the license process is not completed.

- Multi-year licenses are issued with annual validity, supported by an official multi-year confirmation letter, and automatically renewed each year.

2. Mandatory Associated Fees (Establishment Card & Visa Processing)

| Fee Item | Typical Cost (AED) | Notes |

|---|---|---|

| Establishment Card (1st Year) | 2,000 | One-time fee to register with immigration. |

| Establishment Card (Annual Renewal) | 2,200 | Required annually. |

| Residence Visa – Employee | 3,750 | Per applicant, valid for 2 years. |

| Residence Visa – Investor/Partner | 4,750 | Per applicant, valid for 2 years (includes surcharge). |

| Medical Examination | ~870 | Mandatory per applicant. |

| Emirates ID Application | ~370 | Mandatory per applicant, linked to 2-year visa validity. |

| Medical Insurance (Basic) | 992+ | Mandatory, varies by provider. |

3. Office Space & Registered Address Costs

| Office Type | Typical Annual Cost (AED) | Best For |

|---|---|---|

| Flexi Desk | 5,760 – 10,000 | Startups / freelancers needing co-working. |

| Private Office | 7,500 – 40,000+ | SMEs requiring dedicated workspace. |

| Warehouse | Varies | Logistics, trading, or manufacturing. |

4. Other Potential Costs & Annual Renewals

- Annual Renewals: Same as year one (unless on multi-year plan). Establishment Card renewal AED 2,200.

- Business Consultant Fees: AED 2,000 – 8,000.

- License Amendment Fee: AED 2,000.

- Company Liquidation Fee: ~AED 2,000 – 2,500 + audit certificate.

- Late Renewal Fee: AED 1,000 + AED 100 per month.

Estimated Total Setup Costs for 2025 (Sample Scenarios)

| Scenario | License Cost (AED) | Visa & Establishment Fees (AED) | Estimated Service Fees (AED) | Estimated Total (AED) |

|---|---|---|---|---|

| No Visa | 12,900 | 0 | 2,000 – 5,000 | 14,900 – 17,900 |

| 1 Investor Visa | 14,900 | 7,990 | 3,000 – 6,000 | 25,890 – 28,890 |

| 3 Employee Visas | 18,900 | 16,230 | 5,000 – 8,000 | 40,130 – 43,130 |

Additional IFZA Fees (As per IFZA Schedule of Fees Sept 2024)

- Cross Business Activity Fee (professional + commercial): AED 2,000

- Additional Individual Shareholder: AED 350

- Pre-Approval / Name Reservation: AED 500 (deducted from license fee)

- Lock-In Downpayment: AED 5,000 (deducted from license package)

- Establishment Card – Initial: AED 2,000; Renewal: AED 2,200

- Amendment to Establishment Card: AED 500

Step-by-Step Guide: How to Set Up IFZA Free Zone Company

Setting up a business in IFZA can be accomplished within a short timeframe, often 5–10 working days, if you have all your documents in order. Here’s a detailed breakdown:

Step 1: Define Your Business Activity & License Type

- Conduct Market Research: Identify which category Professional, Commercial, Industrial, or Branch aligns best with your business model.

- Check Activity Compatibility: Ensure the activities you plan to undertake are permitted under your chosen license.

Step 2: Choose a Company Name

- Draft a Few Options: Dubai has specific rules regarding naming conventions (e.g., no offensive terms, no religious references, etc.).

- Check Availability: Perform a quick name availability search with IFZA or your business setup consultant.

Step 3: Gather Required Documentation

Depending on whether you’re applying as an individual shareholder or a corporate entity, the documentation can vary slightly.

For Individuals:

- Passport Copy (valid for at least 6 months)

- Visa Copy (if UAE resident)

- Emirates ID (if UAE resident)

- Passport-sized Photos (digital)

- UBO Declaration (Ultimate Beneficial Owner)

For Corporate Entities:

- Certificate of Incorporation

- Memorandum & Articles of Association (MOA/AOA)

- Certificate of Good Standing

- Certificate of Incumbency

- Board Resolution permitting branch/subsidiary formation

- Passport copies for company directors and/or shareholders

Note: Documents may need to be attested and legalized in your home country and/or the UAE. Always confirm with IFZA or a professional business consultant.

Step 4: Submit Application & Pay Initial Fees

- Initial Payment: Usually covers license registration, name approval, and initial documentation costs.

- E-Legal Forms: IFZA will issue e-legal forms that must be digitally signed by all shareholders.

Step 5: Approval & Issuance of IFZA License

- Application Review: IFZA reviews your documents and checks compliance with UAE regulations.

- License Issuance: Once approved, you’ll receive a digital copy of your license. The physical copy may be collected from IFZA’s office or couriered upon request.

Step 6: Visa Processing (If Required)

- Entry Permit: If you’re not a UAE resident, an entry permit may be needed for your visa.

- Medical & Emirates ID: Applicants must undergo medical tests and file for an Emirates ID.

- Residence Visa Stamping: After approval, your passport will be stamped with a UAE residence visa.

Step 7: Bank Account Setup & Operational Launch

- Select a Bank: Dubai’s local and international banks (e.g., Emirates NBD, ADIB, HSBC) welcome IFZA companies.

- Submit Corporate Documents: Provide your trade license, MOA, share certificates (if any), and other relevant papers.

- Start Operations: Once your bank account is active and you’ve secured premises (virtual or physical, if needed), you’re ready to trade or offer services.

Business Registration Process

Incorporating a Free Zone business at IFZA is straightforward for both individual and corporate shareholders. While the steps are similar, document requirements may differ if corporate entities are involved. Typically, you’ll need:

- Registration Application: Indicating shareholders, activities, and license type

- Passport & ID Copies: For shareholders/directors

- Proof of Address: Recent utility bills or tenancy contracts

- NOC (No Objection Certificate): If you hold a UAE visa from another employer

- Attested & Notarized Documents: For corporate shareholders, including certificate of incorporation

Timeline: With proper documentation, approval can come within 3-5 working days.

Visa Requirements and Process

One of the major advantages of setting up your company in IFZA is the flexibility to sponsor both employees and dependents. Below is an outline of the standard visa process once your company is registered.

8.1 Visa Eligibility

- Shareholders: Can apply for investor visas valid for up to 2 years.

- Employees: Each employee visa typically follows a 2-year validity.

- Dependents: Family sponsorship is possible but depends on your salary bracket and accommodation requirements.

8.2 Documentation Needed

- Original Passport (valid at least 6 months)

- Passport Photo (white background)

- Copy of IFZA Trade License

- Establishment Card (Issued to your new IFZA company)

8.3 Step-by-Step Visa Process

- Entry Permit: Issued electronically, allowing you to enter the UAE if you are not already inside the country.

- Medical Examination: Mandatory health screening for tuberculosis, HIV, and other conditions.

- Emirates ID Application: Biometrics (fingerprinting) at designated centers.

- Residency Visa Stamping: The final stage, where your passport is stamped (or an e-visa is issued) signifying your legal residence in the UAE.

Note: The visa process typically ranges between 1 to 2 weeks, depending on the volume of applications and your personal documentation readiness.

Competitive Analysis: IFZA vs. Other Free Zones

To fully appreciate IFZA’s value proposition, let’s briefly compare it with a few other well-known Free Zones in the UAE.

| Free Zone | Strengths | Drawbacks |

|---|---|---|

| DMCC (Dubai Multi Commodities Centre) | Award-winning zone, strong global reputation, robust infrastructure especially for commodities trading (e.g., gold, diamonds). | Setup costs can be higher; the registration process might be more complex due to stringent compliance checks. |

| JAFZA (Jebel Ali Free Zone) | Proximity to the Jebel Ali Port (one of the largest ports in the world), ideal for large-scale manufacturing and logistics. | Tends to be more suitable for medium-to-large enterprises; overhead costs (office rent) can be significant. |

| RAKEZ (Ras Al Khaimah Economic Zone) | Competitive pricing, variety of industrial and commercial facilities, simpler business environment outside of Dubai. | Being located in Ras Al Khaimah might be less convenient for international clients who prefer Dubai’s global connectivity. |

| Shams (Sharjah Media City) | Focus on creative and media ventures, often lower licensing fees than Dubai-based Free Zones. | Sharjah’s brand recognition is improving, but it’s still overshadowed by Dubai’s global business reputation. |

Why IFZA is the Best Choice

- More Affordable Packages: Especially for new and small businesses with limited capital.

- Streamlined Incorporation: Known for a smoother, quicker process overall.

- Strategic Dubai Address: Business owners can leverage Dubai’s strong brand and connectivity.

- Flexibility in Activities: Combining different activities under one license is relatively simpler compared to some Free Zones.

By choosing IFZA for your business setup, you position your company within a supportive ecosystem that emphasizes efficiency, flexibility, and growth, making it an ideal choice for entrepreneurs aiming to establish a strong foothold in Dubai’s vibrant economy.

Key Business Activities in IFZA

Here are some of the top business activities available in IFZA:

| Activity Code | Activity Name | Description | Type | Property Requirements | Classification |

|---|---|---|---|---|---|

| 3212002 | Imitation Jewellery Smithing | Manufacturing goldsmiths’ articles, such as brooches, earrings, necklaces, and bracelets made from base metals plated with precious metals or containing imitation stones. | Professional | Requires office/retail space | Non-Regulated |

| 3290024 | 3D Printing Products Production | Firms specialized in producing products by 3D printing, including jewelry, industrial parts, vehicles, and medical products. | Professional | Office space required | Non-Regulated |

| 4742002 | Radio, TV Stations, Cinema & Theater Equipment Trading | Reselling of broadcasting, cinema, and theater equipment. | Commercial | No property requirement | Non-Regulated |

| 4510102 | Buses & Trucks Trading | Reselling different passenger buses, trucks, and trailers. | Commercial | No property requirement | Non-Regulated |

| 4510103 | Specialized Vehicles Trading | Reselling specialized vehicles, including ambulances and fire engines. | Commercial | No property requirement | Non-Regulated |

| 4510104 | Specialized Electric Cars Trading | Reselling electric mini cars for golf clubs, stadiums, airports, and malls. | Commercial | No property requirement | Non-Regulated |

| 4510201 | Used Luxury Automobiles Trading | Selling high-end luxury automobiles with a price not less than AED 700,000. | Commercial | No property requirement | Non-Regulated |

| 4510202 | New Automobile Trading for Export | Firms dealing in exporting new cars only. | Commercial | No property requirement | Non-Regulated |

| 4510902 | Used Trucks Trading | Reselling used trucks for goods transportation. | Commercial | No property requirement | Non-Regulated |

| 4510907 | Classic Cars Trading | Selling classic cars with distinctive engineering standards and designs. | Commercial | No property requirement | Non-Regulated |

For a complete list of all 838 available business activities in IFZA, visit the official directory at activities.ifza.com.

Business Setup Services in UAE

GloboPrime Corporate Services Steps for Business Registration Process

1. Consultation & Proposal

Our journey begins by discussing your business requirements and goals. We then provide a customized proposal. This proposal helps ensure your new company aligns with both UAE regulations and your strategic objectives.

2. Documentation

We will then gather and review the documentation required to form your company. Having accurate, up-to-date documents speeds up subsequent steps in the registration process.

3. Processing

Once your documents are submitted and reviewed:

- IFZA registers the shareholders’ information in the official system

- Upon preliminary approval, the authority will issue two e-legal forms

- These forms must be signed electronically prior to finalizing your incorporation documents

4. License Approval

The relevant Free Zone Authority (in this case, IFZA) reviews your application for compliance with UAE laws and regulations. Once approved, you receive an official confirmation that the license is ready to move into the final stages.

5. MOA/AOA Process

IFZA prepares and sends a digital Memorandum of Association (MOA) and/or Articles of Association (AOA) to all shareholders for e-signatures.

6. License Issuance

With all signatures in place, IFZA issues your Free Zone License:

- A soft copy is emailed to you promptly

- The original license can be collected from IFZA’s office upon request

At this point, your Free Zone company is officially established and ready to operate in Dubai.

For expert guidance on business setup in IFZA, contact us today and let us help you build a successful enterprise in Dubai!

PRO Services in International Free Zone Authority (IFZA) in Dubai

PRO (Public Relations Officer) services act as the crucial link between your business and various government departments. This includes handling all documentation, applications, and clearances related to your license, visas, and other legal formalities. Essentially, we handle the bureaucracy so you can focus on building your business.

Our Comprehensive IFZA PRO Services Include:

Company & License Management:

- Trade Name reservation and registration

- Drafting legal documents (MOA & AOA)

- New trade license issuance

- License renewals, amendments, and cancellations

Visa & Immigration Processing:

- Company Establishment Card application

- Investor and employee residence visa processing

- Work permits and labor card applications

- Assistance with medical tests and Emirates ID biometric appointments

- Visa stamping and cancellation

Document Management:

- Document clearing from government and semi-government bodies

- Notarization and legal attestation of documents

Operational Setup:

- Assistance with tenancy contracts and Ejari registration

Company Liquidation in IFZA

Closing a business is a significant decision. A compliant and properly managed liquidation process is crucial to protect shareholder interests, avoid future liabilities, and maintain your professional reputation. Our experts guide you through every step of the company liquidation process in IFZA, ensuring a clear, orderly, and stress-free exit.

If your company faces unexpected challenges or a change in direction, it’s vital to follow the official procedures for closure instead of simply letting the trade license expire.

Our Step-by-Step Guide to IFZA Company Liquidation:

- Board Resolution: The process begins with a formal resolution passed by all shareholders, officially approving the decision to liquidate the company.

- Initial Submission: We submit the board resolution and other required corporate documents to the IFZA authority to formally initiate the cancellation request. This must be done at least one month before the license expiry.

- Clearance & Settlements: All outstanding dues must be cleared. This includes cancelling all employee visas, settling payments with the Free Zone, and resolving any outstanding balances with suppliers or partners.

- Auditor’s Liquidation Report: An accredited auditor must prepare a liquidation certificate, which is then submitted to IFZA. This officially confirms the company’s financial status is settled.

- Final Certification & Refunds: After paying the necessary fees, we will obtain the official Trade License Cancellation Certificate from IFZA on your behalf and process any eligible refund requests.

Ensure your business concludes on the right note. Contact our expert consultants for a confidential discussion about company liquidation in IFZA.

FMCG Company Setup Cost in Dubai

Starting an FMCG business in Dubai involves several essential steps and associated expenses that vary depending on the business model, jurisdiction (mainland or free zone), and scope of activities. Below are the major cost elements:

- Local Sponsor Charges

- Labour & Immigration Costs

- Trade License Issuance Fee

- Visa Processing Expenses

- Office/Warehouse Lease

- Company Registration Charges

- Special Government Approvals (if required)

The process typically begins with defining your commercial activity, selecting a compliant trade name, and submitting incorporation documents to the relevant authorities. This is followed by setting up a corporate bank account and applying for investor or employee visas.

These procedures may differ based on the license category and nature of operations. Consulting a company formation expert is highly advisable, as they can streamline compliance, manage paperwork, and often finalize the setup in just a few working hours. This ensures a cost-efficient and legally sound entry into Dubai’s dynamic FMCG sector.

Documents Required for IFZA Company Formation

Having the correct documents ready is the key to a fast setup. We provide a simple checklist below.

IFZA Company Setup Document Requirements

For Individual Shareholders:

- Passport Copy (clear, color, with at least 6 months validity)

- Passport-sized Digital Photo (white background)

- Emirates ID & Visa Copy (if you are already a UAE resident)

For Corporate Shareholders:

- Parent Company Certificate of Incorporation

- Parent Company Memorandum & Articles of Association

- Board Resolution to establish a new company in IFZA

- Passport copies for the Directors, Manager, and UBOs

Why Choose Us for IFZA Business Setup?

| Our Strength | What You Gain |

|---|---|

| ✅ IFZA Expertise | Specialized knowledge of IFZA’s licensing packages, visa quotas, and compliance requirements. |

| ✅ End-to-End Formation | Company licensing, shareholder visas, Establishment Card, office solutions, and bank account setup all managed for you. |

| ✅ Fast Processing | Business license issued within 5–10 working days with minimal paperwork and remote setup options. |

| ✅ Flexible Packages | Access to IFZA’s cost-effective multi-year licenses, free visa promotions, and activity combinations. |

| ✅ Pan-UAE Support | Dedicated consultants assisting you in Dubai and across the UAE for smooth incorporation and renewals. |

| ✅ Transparent Pricing | Clear, upfront cost structures with no hidden charges—know your total investment before you start. |

Ready to start company in IFZA Free Zone?

Take the first step towards launching a successful IFZA business setup. Contact our expert consultants today for a free, no-obligation consultation.

- Degree Certificate Attestation

- Master Degree Attestation

- Diploma Certificate Attestation

- Engineering Certificate Attestation

- Bachelor Certificate Attestation

- PhD Degree Attestation

- Mark Sheets Attestation

- Marriage Certificate Attestation

- Birth Certificate Attestation

- School Leaving Certificate Attestation

- Divorce Certificate Attestation

- Transfer Certificate Attestation

- Medical Certificate Attestation

- Death Certificate Attestation

- Experience Certificate Attestation

- Board Resolution Attestation

- Commercial Invoices Attestation

- Certificate of Origin Attestation

- Memorandum of Article Attestation

- Shareholders Resolution Attestation

- Certificate of Incorporation Attestation

- Memorandum of Association Attestation

- Articles of Association Attestation

Embassies Attestation

- Saudi Embassy Attestation Abu Dhabi & Dubai

- Philippine Embassy Attestation UAE

- Russia Embassy Attestation UAE

- Australian Embassy Certificate Attestation UAE

- Egypt Embassy Attestation UAE

- Portuguese Embassy Attestation Abu Dhabi

- Kuwait Embassy Attestation UAE

- Malaysia Embassy Attestation UAE

- France Embassy Attestation UAE

- German Embassy Attestation UAE