Starting a business in the UAE requires a thorough understanding of legal and regulatory procedures. Company registration and document attestation are pivotal steps in establishing your business presence in the UAE. Attestation is the process that verifies the authenticity of your documents, ensuring they are recognized by UAE authorities, and is mandatory for completing your company registration, securing visas, and accessing banking services.

The UAE is a prime destination for business due to its strategic location, world-class infrastructure, and favorable tax environment. Setting up a business here involves navigating through a variety of legal structures and compliance requirements. The two most popular options are Free Zone and Mainland setups.

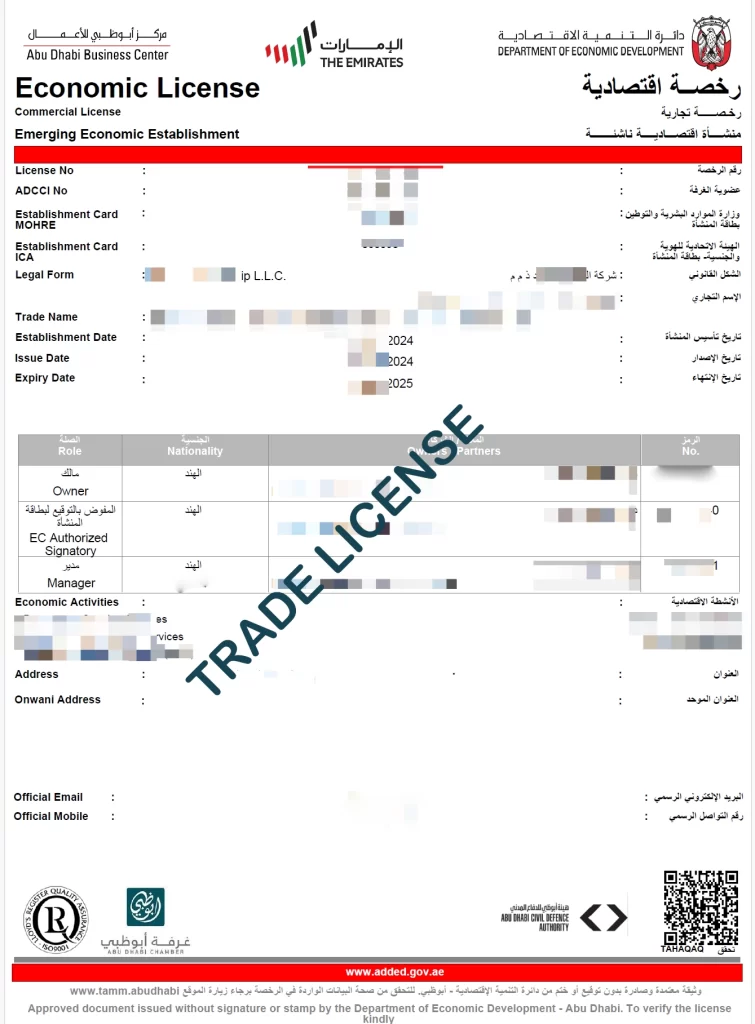

Trade license attestation is a process that validates the authenticity of your trade license, ensuring it meets legal standards. The Ministry of Foreign Affairs (MOFA) attestation is often required for various legal and business purposes. Here’s a step-by-step guide:

A trade license in the UAE is a mandatory legal document that permits businesses to operate within the country. Issued by the Department of Economic Development (DED) in the respective emirate, this license is crucial for the lawful functioning of any business entity. A trade license in the UAE is an essential legal document that permits businesses to operate within the country. Issued by the Department of Economic Development (DED), it ensures compliance with the UAE’s regulations and standards. Here are the main types of trade licenses available:

:A trade license in the UAE is an essential legal requirement for businesses, providing the authorization to conduct various commercial activities. It is critical for compliance with local regulations and smooth business operations.

When considering business setup in the UAE, selecting the appropriate business structure is crucial. Here are the primary types of business entities:

Governed by the UAE Commercial Companies Law (CCL), mainland companies allow businesses to operate across the UAE and internationally. They are typically registered with the Department of Economic Development (DED) in the relevant emirate.

These are established in designated free zones, offering various incentives such as:

This structure allows foreign companies to open branches in the UAE. Key features include:

To establish a branch of a foreign company in the UAE, the process involves several steps, each requiring careful attention to detail:

The UAE’s strategic location offers access to markets in the Middle East, Africa, and Asia. It is a key hub for global trade, with world-class ports and airports facilitating international business operations.

The UAE boasts state-of-the-art infrastructure, including advanced telecom networks, modern highways, and world-class logistics facilities, making it an ideal base for international operations.

The UAE government provides robust support for businesses through initiatives like 100% foreign ownership, streamlined visa processes, and extensive investment in innovation and technology sectors.

Opening a branch of a foreign company in the UAE requires strict adherence to legal formalities, including the attestation of essential commercial documents. Proper attestation ensures that your documents are recognized by UAE authorities, facilitating a smooth setup process for your branch.

Ensure all documents, such as the Memorandum of Association (MOA), Articles of Association (AOA), and Board Resolutions, are duly prepared in English or Arabic. If the original documents are in another language, they must be translated by a certified translator.

All commercial documents must first be notarized by a notary public in the country where the parent company is incorporated. This step validates the authenticity of the signatures on the documents.

The notarized documents should be attested by the Ministry of Foreign Affairs in the country of origin. This step confirms that the documents are recognized by the home government.

Once the documents are attested by the home country’s MOFA, they must be further attested by the UAE Embassy or Consulate in that country. This is a crucial step as it ensures that the documents are recognized by UAE authorities.

Upon arrival in the UAE, the documents need to be attested by the UAE MOFAIC. This is the final attestation step and ensures the documents are legally valid for use in the UAE.

After attestation, submit the documents to the Ministry of Economy (MoE) or the relevant free zone authority to proceed with branch registration and licensing. Ensure that you meet all specific requirements of the local authority where the branch is being established, such as Dubai Development Authority (DDA) if in a Dubai Free Zone.

Attestation from the Chamber of Commerce is typically required for documents related to company formation and operation, such as:

Attested documents are vital for registering your company with the relevant authorities (Department of Economic Development, free zone authority, etc.). These documents provide proof of your identity, business purpose, and legal standing.

Attested educational certificates, employment documents, and other relevant documents are required for obtaining residency visas for you and your employees.

Banks in the UAE require attested documents to verify your identity and establish your company's legitimacy, facilitating smooth financial transactions.

Attested documents add weight and enforceability to all business contracts and agreements, ensuring clarity and legal protection for all parties involved.

Businesses in the UAE must keep their commercial books and supporting documents for a minimum of five years from the date the book is closed.These books could be requested for verification during attestation procedures.

Attestation for Power of Attorney documents need to be attested by the issuing authority, the Ministry of Foreign Affairs in your home country, and the UAE Embassy.

Registration in the commercial register is mandatory for businesses. Attestation might be required for documents used during registration.

Attestation is a vital part of setting up a business in the UAE. The attestation process can be intricate and time-consuming. Consider consulting a business setup service expert like GloboPrime specializing in UAE requirements to ensure accuracy and avoid delays. business setup in the UAE. We provide fast, reliable, and cost-effective attestation services for all types of documents

We review your documents to ensure they meet the necessary criteria for attestation.

The documents are verified by a notary public to confirm authenticity.

For commercial documents, we obtain certification from the relevant Chamber of Commerce.

We then proceed with MOFA attestation, which is mandatory for all documents to be recognized abroad.

The final step involves legalization by the embassy of the destination country.

We have successfully facilitated the attestation of documents for hundreds of various clients, enabling smooth